Tenant screening helps landlords and property managers determine if prospective tenants meet their rental requirements. Income verification is an essential component of this process, as it helps verify that you earn enough money to cover your rent. Before you apply for a rental, make sure you’re prepared to go through income verification.

How Does Income Verification Impact Tenant Screening?

Income verification helps property owners manage risk. If a prospective tenant has a steady source of income, they’re less likely to make late payments. The verification process also benefits you as a tenant. When a landlord verifies your income, you have the opportunity to determine if you can truly afford the monthly rent.

A prospective landlord may require you to go through income verification and employment background screening at the same time. Employment background screening helps verify your employment status and make sure that you have a steady employment history.

Failure to provide the required documents may prevent you from qualifying for a rental. Even if the landlord allows you to move in, you may have to pay a higher deposit or ask a family member to cosign your lease.

Common Challenges With Income Verification

Some landlords are still using manual tenant screening processes, which require you to procure hard copies of important documents. It takes time to gather these documents, especially if you have to wait for your employer to write a verification letter or issue a W-2.

If you own a business or provide freelance services, you won’t be able to provide third-party pay stubs or other employment documentation. You may have to create pay stubs for your self-employment income, provide copies of 1099 forms issued by clients or submit copies of your bank statements to show the landlord you receive regular deposits.

Some people have inconsistent income due to seasonal fluctuations. For example, if you work as a landscaper, you may receive the bulk of your income in the spring and summer. If you have seasonal income, be prepared for prospective landlords to request 2 years’ worth of pay stubs. You may also have to provide bank statements.

How Long Does the Income Verification Process Take?

With manual processes, income verification may take several weeks, especially if you have to wait for your employer to provide the necessary documents. Some property management companies use instant databases, which may take up to 24 hours.

During this process, you may have to provide pay stubs, tax forms, bank statements and other financial documents. If you forget to submit a required document, it will take even longer to complete the verification.

What Can You Do to Pass Income Verification?

If you want to pass income verification on the first try, start gathering income-related documents before you apply for a rental. Give your employer plenty of lead time to provide a verification letter or give you copies of missing documents.

It’s also important to be transparent. If your financial situation is unusual, tell the landlord right away. Be prepared to offer additional documents, such as bank statements, to show the property owner that your unusual situation won’t cause you to make late payments or violate your lease.

If anything changes during the verification process, let the landlord know right away. For example, if you accept a new job with a higher salary, you should obtain a verification letter from your new employer before the landlord does a rental background check. If you experience an income loss, don’t try to hide it from the property owner.

Alternatives to Traditional Income Verification

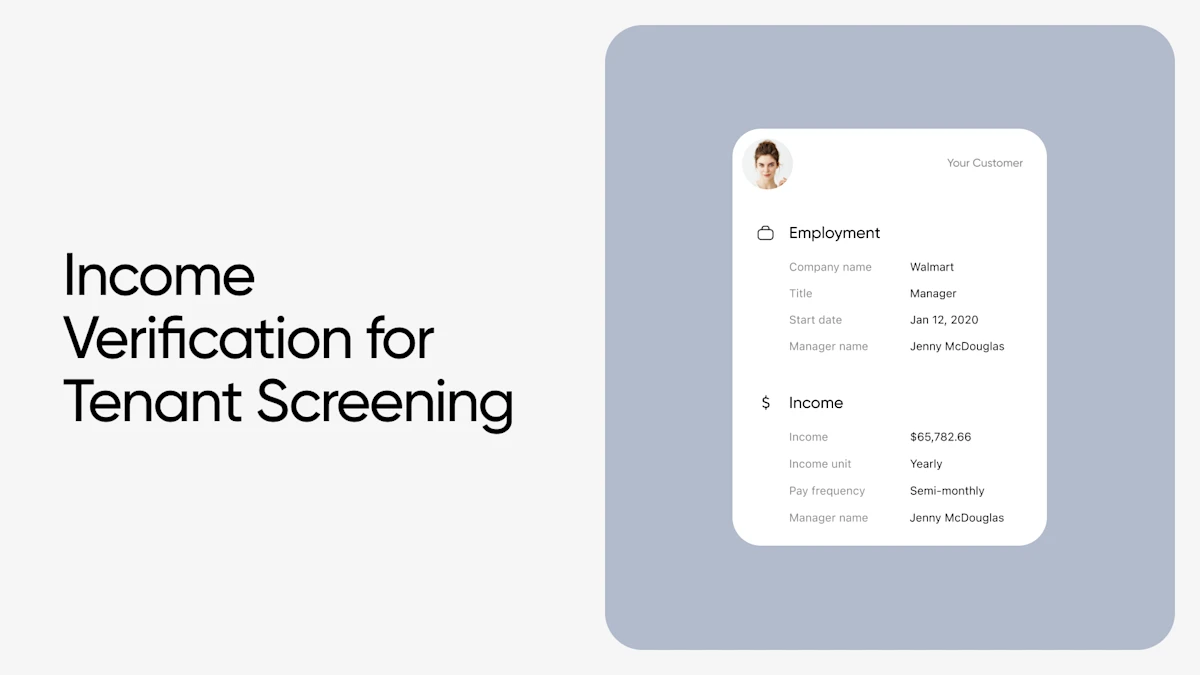

Consumer-permissioned verification is the fastest method, as it enables direct connections to employers and payroll providers. This eliminates the need to obtain hard copies of documents from your employer. Truv’s consumer-permissioned income verification service also allows tenants to connect directly to their payroll providers and financial institutions. Once you successfully connect by logging into your provider or bank, the tenant screener automatically receives the required data for your verification in seconds.

Truv even has a document upload tool as a backup. If your employer or payroll provider doesn’t make its data available to third parties, you can use the upload tool to provide digital copies of required documents.

With Truv, income verification is easy. Simply:

- Log in to your payroll provider or financial institution via the Truv Bridge.

- Authenticate access for Truv to safely retrieve data required by the tenant screening service.

Our consumer-permissioned process gives property owners access to real-time data, ensuring they always have the most up-to-date information. On average, it takes less than 1 minute for prospective tenants to complete the authentication process.

Truv connects to more than 13,000 institutions and has 71% OAuth connections to protect sensitive data and safeguard consumers.

Frequently Asked Questions

What do landlords look for in income verification?

Landlords look for evidence that you can afford to make your monthly rent payments. They may ask for pay stubs, tax returns and other documents to determine how much you earn. Some landlords even require you to earn two to three times the monthly rent.

How can I prove my income without pay stubs?

You may be able to prove your income by providing W-2 forms, tax returns and other tax documents. A prospective landlord may also be willing to accept a verification letter written on your employer’s letterhead.

Can I rent an apartment with an inconsistent income?

It depends on the landlord. Some landlords aren’t willing to make exceptions to their income requirements. Others will rent to you if you provide bank statements or other documents to demonstrate that you have a stable financial situation.

How far back do landlords check your income?

Again, it depends on the landlord. Some landlords verify your income for the previous 12 months, while others require additional information. If you rent from a private landlord, they may ask for just a few recent pay stubs.

What happens if I fail income verification?

If you fail income verification, you may not be able to rent from your preferred landlord.