Paycheck Pay

Automate loan repayment from the paycheck.

Reduce default rates and approve more loans.

visibility

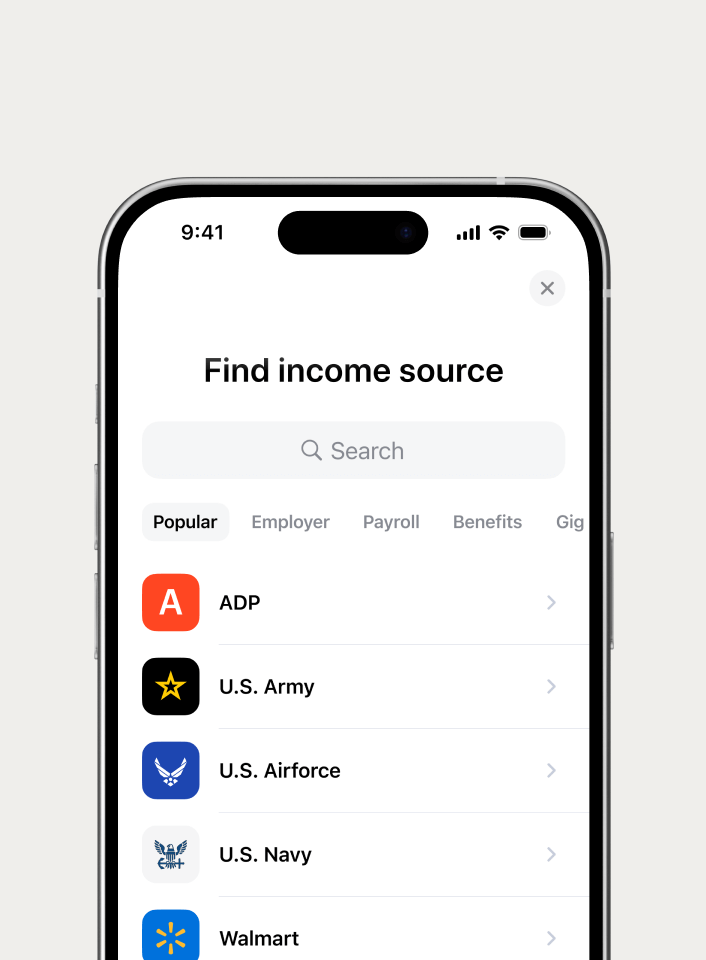

Verify income & employment.

Gather the necessary income and employment details to approve loans.

Get StartedRISK

Reduce default rates.

Significantly decrease default rates by increasing repayment rates.

Get Started

GROWTH

Approve more loans.

Approve loans to lower credit applicants who previously would be declined.

Learn moreWATERFALL

Reduce costs.

No need to pay ACH and authentication expenses to pull money from the applicant’s bank account.

Get Started

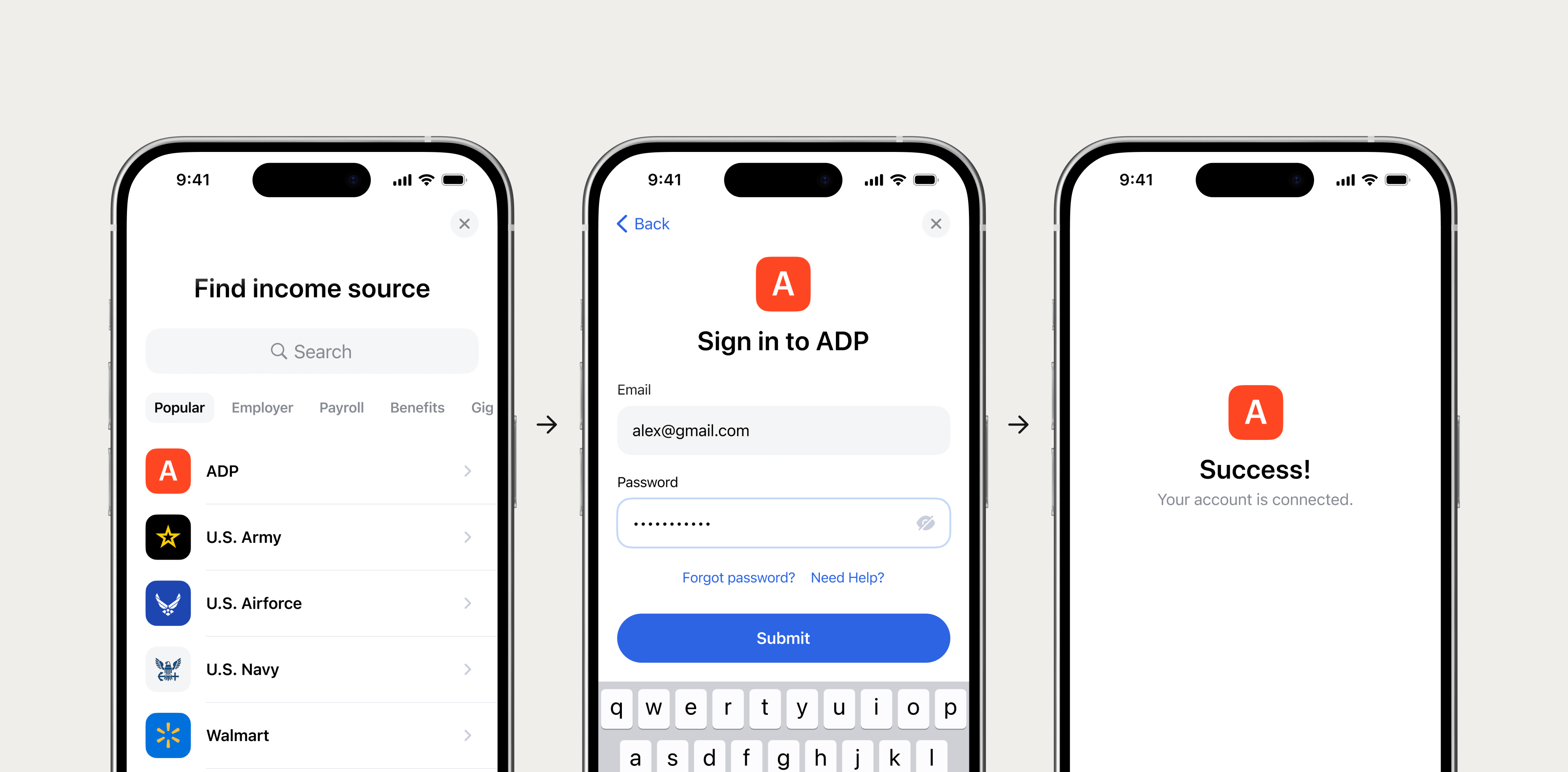

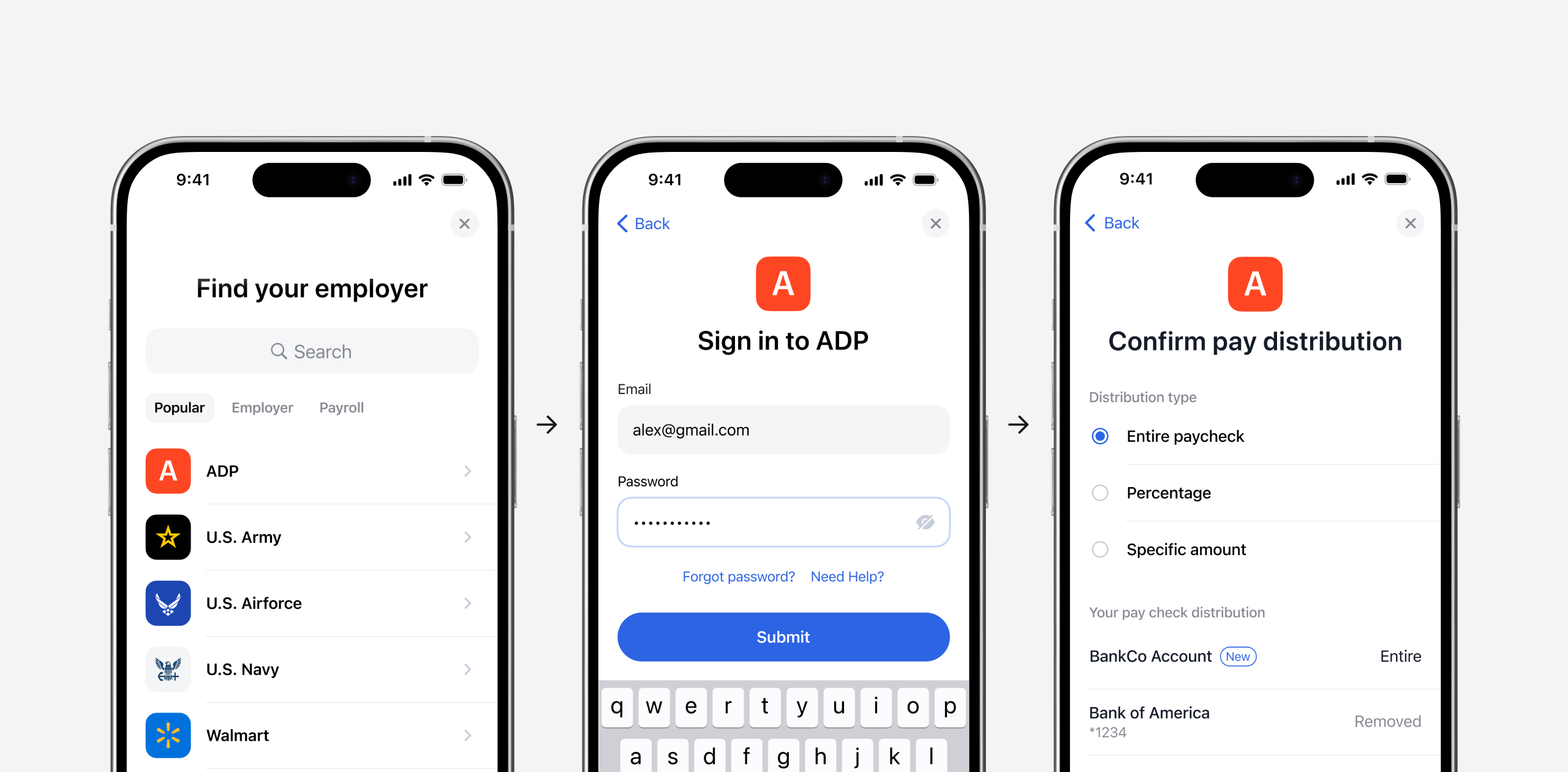

How it works.

How it works.

Why partner with Truv?

Why partner

with Truv?

95% API integrations.

Integrations that aren’t blocked by payroll providers. High data quality with high 90% fill rates.

Learn more

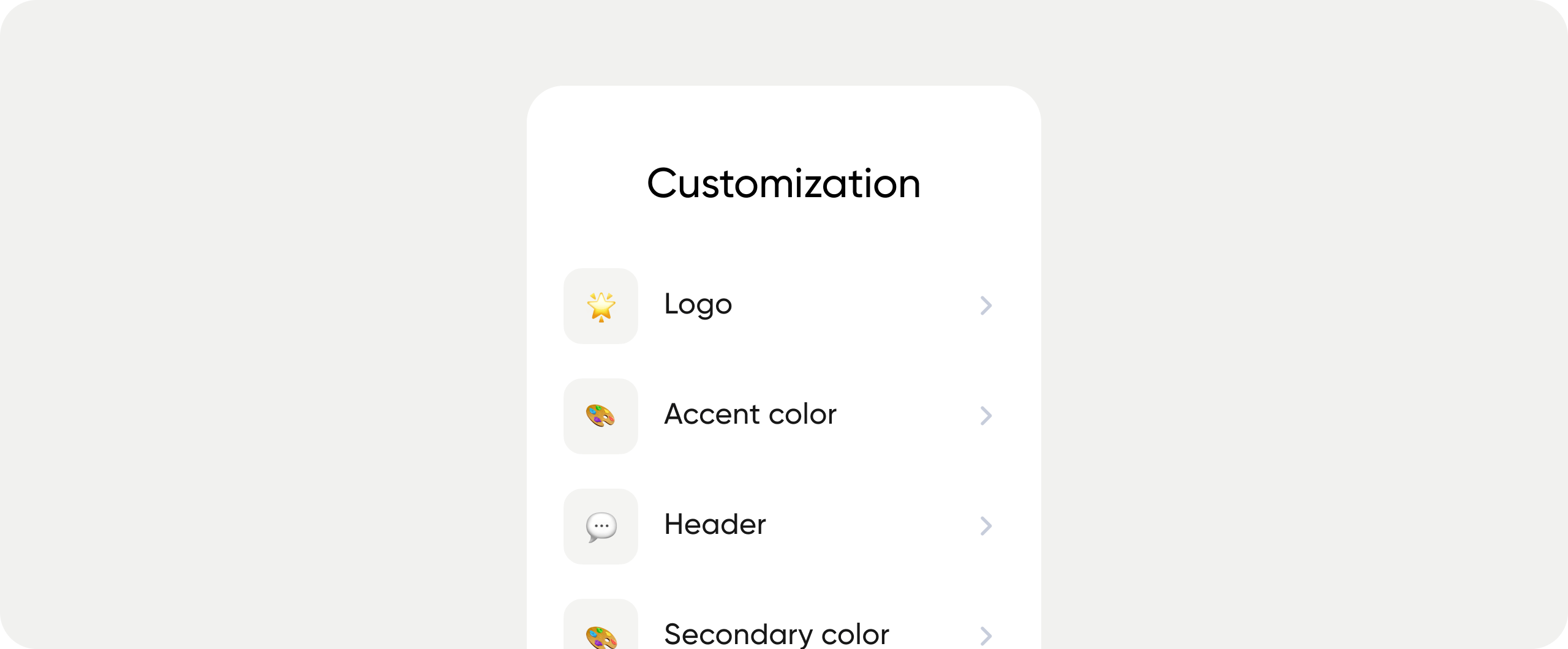

Compliance & security.

FCRA-compliant consumer reports. SOC 2 Type II reports and continuous monitoring.

Get Started

Highest conversion rates.

Integrations with the top 43 single-sign on providers. 289k+ employers mapped to payroll providers.

Get Started

All-in-one platform

for verifications.

All-in-one platform for verifications.

Paycheck Pay Solution FAQs.

Paycheck Pay Solution FAQs.

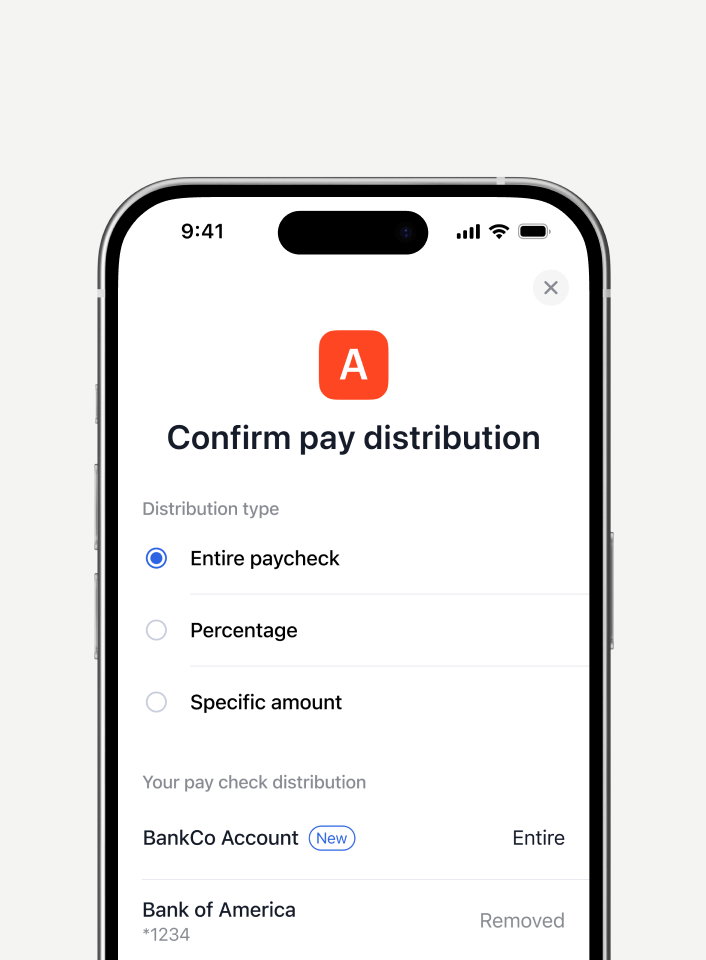

Truv automates loan repayments directly from borrowers’ paychecks, empowering consumers and reducing lender risk.

Consumer lenders and auto lenders leverage Truv’s consumer-permissioned paycheck-linked lending solution to increase approved loans and reduce default rates.

Truv’s solution automates loan repayment by tapping into payments directly from the consumer’s connection to their payroll provider.

The platform offers market-leading coverage of 220.3M+ Americans and 2.3M+ employers including federal, Fortune 1000, NASDAQ, healthcare, military, and gig platforms.

40%+ of the population has low or no credit score. Traditional criteria o credit score. Traditional criteria disqualifies potential applicants. With Truv, lenders can scale growth and approve more loans to lower credit applicants loans to lower credit applicants.

Traditional methods incur unnecessary costs, like ACH & authentication expenses to pull money from an applicant’s account. With Truv, customers are empowered with a cost-effective solution that matches their payment preference and provides an easy installment setup.

Truv safeguards consumer data through multiple security and privacy measures, including operating as a credit reporting agency (CRA) and adhering to Fair Credit Reporting Act (FCRA) standards, implementing SOC2 Type II compliance protocols, utilizing application-level encryption to protect sensitive information, maintaining compliance with privacy regulations, and performing continuous security monitoring to identify and address threats in real time. This approach eliminates the need for consumers to email sensitive financial documents directly to lenders or landlords, reducing the risk of data breaches and unauthorized access to personal information.

Brad Powers

Chief Marketing Officer at Luther Sales