Mortgage Lending

Mortgage income and employment verification in minutes.

Accelerate loan closing with our AIM & D1C solutions.

Verification of income & employment,

assets and insurance — all in one platform.

Verification of income & employment, assets and insurance — all in one platform.

Maximize savings.

Reduce repurchases.

Accelerate approvals.

Why partner with Truv?

Why partner

with Truv?

Bridge

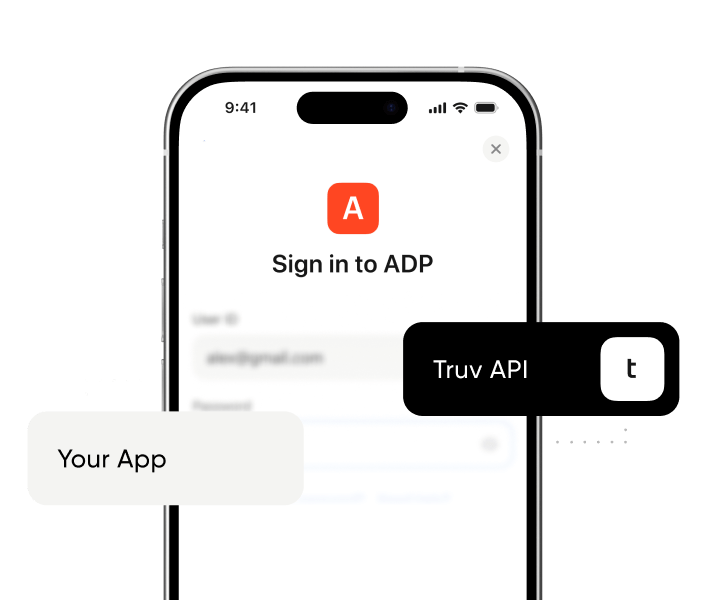

Verify borrowers instantly.

User experience optimized for high conversion and minimum friction.

Learn more

Quality

Use real-time, accurate data.

Direct to source data. Approved by Freddie Mac and Fannie Mae.

Learn more

Assets

Verify using bank accounts.

With over 13K+ financial institutions & AI- driven deposit detection.

Learn moreIntegrations

Implement Truv in days.

All top POS/LOS integrations and dedicated success team.

See IntegrationsWaterfall

Use one platform for all verifications.

Verify 100% of borrowers using waterfall and save up to 80% on verifications.

Learn more

Justin Venhousen

COO at Compass Mortgage

“Truv has given us the ability to lower costs, all

while speeding up the verification process and

providing better employment data for our

operations team. Truv has been a great partner

for Compass Mortgage.”

“Truv has given us the ability to lower costs, all while speeding up the verification process and providing better employment data for our operations team. Truv has been a great partner for Compass Mortgage.”

Cost Savings

Save 80%+ vs instant databases.

Increase margins by $350 per closed loan. Free re-verifications within 120 days.

Get StartedGrowth

Increase pull through rates.

Customers who use Truv verifications suite have higher NPS, close faster and more often.

Get Started

Reduce Risk

Reduce repurchase risks.

Decreased fraud risk with data directly from the source. Lower risk of repurchases.

Get Started

Increased Efficiency

Reduce manual verifications

Less dependency on manual labor and fixed expenses. 100% solution to verifications via Waterfall.

Get Started

All-in-one platform

for verifications.

All-in-one platform for verifications.

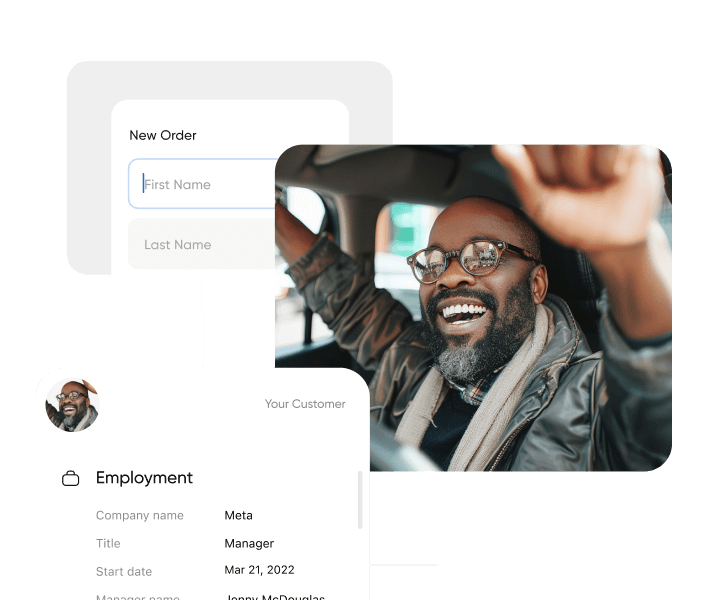

Income & Employment Verification

Payroll Income & Employment

Highest conversion rate and data fill rates in the industry.

Paystubs & W-2s

Best-in-class OCR and fraud detection for pay documents.

Asset Verification

Bank Assets

Highest oAuth rate and insights into bank assets & cash flows.

Platform

Streamline lending

with Truv.

Streamline lending with Truv.

Mortgage lending verification FAQs

Mortgage lending verification FAQs

Truv offers a comprehensive platform for verifying borrowers’ income quickly and accurately. Our service provides real-time, direct-source data for mortgage lenders, helping to streamline the loan approval process.

For mortgage income verification, borrowers typically need recent pay stubs, tax returns, W-2 or 1099 forms, bank statements, profit and loss statements (for self-employed), a verification of employment, social security or pension award letters (if applicable), rental income documentation, alimony/child support proof (if applicable), and asset statements.

Yes — Truv’s verification service uses direct connections to payroll providers to instantly verify a borrower’s employment status. This ensures lenders have up-to-date and accurate information for mortgage applications. Typically, Truv does a backend refresh from the origination request, requiring no additional engagement from the borrower. In cases the backend refresh fails, the borrower is notified to re-authenticate into the payroll system.

Lenders can save up to 80% on verification costs compared to traditional methods. On average, using Truv can increase margins by $350 per closed loan.

Truv differentiates itself through: 1. Direct-to-source data approved by Freddie Mac’s Asset and Income Modeler (AIM) and Fannie Mae’s D1Certainity programs. 2. Best-in-class coverage (96% of US workforce) and user experience for high conversion rates. 3. An all-in-one platform for various types of verifications (income, employment, assets, insurance). 4. Integrations with top Point of Sale (POS) and Loan Origination Systems (LOS). 5. Waterfall verification system to cover 100% of borrowers.

Truv is an authorized report supplier for Fannie Mae’s Desktop Underwriter® (DU®) validation service and an approved provider of Freddie Mac’s Loan Product Advisor® (LPASM) asset and income modeler (AIM). Truv is integrated with several leading loan origination platforms, including Encompass® by ICE Mortgage Technology®, Dark Matter Technology’s Empower, BYTE Software, and various Point of Sale systems, including nCino Mortgage Suite, Floify, BeSmartee, LenderLogix and LodaSoft.

Lenders can use Truv in 1 of 3 ways: Out-of-the box in readily integrated LOS platform, out-of-the box in readily integrated POS platforms, or a no-code solution via Truv’s admin portal where operations team can go live in days. All of Truv’s solutions are readily available through API’s and can go live in a matter of weeks.

Yes, Truv provides asset verification services using bank account information.

Truv helps reduce repurchase risks by providing accurate, direct-source data. This decreases the likelihood of fraud and ensures compliance with Fannie Mae and Freddie Mac requirements.

Yes, Truv offers a comprehensive verification suite including income, employment, assets, and insurance verifications all on one platform.

Truv reduces the need for manual verifications, accelerates loan closing processes, and provides instant verification for borrowers, significantly improving operational efficiency for lenders.

Daniel Miller

Senior Director, Strategic Technology Partnerships at Freddie Mac