The pace of Q2 at Truv: full speed ahead. From new product announcements and integrations to updates that improve our customer and borrower journeys using Truv, April is surefire proof that listening to our client feedback and implementing change will always remain a top priority. Let’s get into all that we’ve been building for you!

New Product Announcement

Truv is now approved with Fannie Mae

Truv is now an authorized report supplier for mortgage lenders using Fannie Mae’s Desktop Underwriter® (DU®) validation service.

As an authorized report supplier for the DU validation service, the Truv platform will enable lenders to:

- Enhance security and reduce fraud risk with real-time data directly from the source.

- Save costs by reverifying borrower’s income and employment data at no extra expense.

- Speed up loan processing and boost pull-through rates for faster closings.

- Streamline operations and increase productivity by minimizing time spent on data collection for underwriting.

Check out more details here.

Truv is also a Freddie Mac Loan Product Advisor® asset and income modeler (AIM) service provider, and is the only consumer-permissioned VOIE platform with both accreditations, solidifying our commitment to delivering top-notch verification services tailored for mortgage lenders, banks, and credit unions.

Truv is now integrated with Floify

Floify, an industry-leading Point-of-Sale (POS) for lenders, now supports Truv’s verification of borrower income and employment service via our new integration!

Floify’s customizable borrower journeys and automated task workflows simplify the lending process without the need for extensive development work. Through Floify’s borrower portal, borrowers can opt for electronic verification, allowing Truv to automatically retrieve necessary documents like W-2s, paystubs, and bank statements, expediting the pre-approval process for lenders.

Don’t miss out on this game-changing integration! Read the full scoop here.

If you’re ready to see Truv in action or learn about how Truv could work for you, reach out to the team today.

Truv is now integrated with BeSmartee

Our transformative partnership with BeSmartee, who provides an award-winning Point-of-Sale (POS) platform, Bright POS, for mortgage lenders is officially live!

Through this integration Truv combines its direct-to-source verification power with BeSmartee’s easy-to-use platform to revolutionize the mortgage experience. By automating manual verification processes, we’re paving the way for easier mortgage approvals, heightened data transparency, and faster closings for lenders and borrowers alike.

Ready to learn more about this lights-out solution designed to simplify, automate, and optimize operational workflows while slashing costs on every closed loan?

The full announcement is here.

Truv Platform Updates

Encompass Improvements

When lenders leverage Truv’s integration with Encompass, verifications are easier and faster. That’s why our team looks to level up the user experience in every Sprint. Check out the latest enhancements:

- Hide or Show Links Feature: We’ve implemented a client-level setting that gives our clients the option to show or hide verification links within Order Statuses.

- Unlimited Template View: Access to templates in Encompass UI has always been available, however, previously, this limit was set to 10. Now all template can be viewed in Encompass.

- Current Employer Indication: For borrowers and co-borrowers, we added a ”Current” tag to indicate their current employers, assisting Loan Officers (LO), Loan Officer Assistants (LOA), and processors in identifying the borrower’s current employer and facilitating re-verifications.

- Status Update Emails: The Loan Number, Loan Originator, and Loan Processor details are outlined in status update emails, providing recipients with comprehensive information for efficient tracking and communication.

- Customizable Templates: Users can now customize all returned documents for payroll income and employment to reduce unnecessary data retrieval: select the borrower’s most recent paystub from the last 6 paystubs and obtain any of the last 3 years’ W2s.

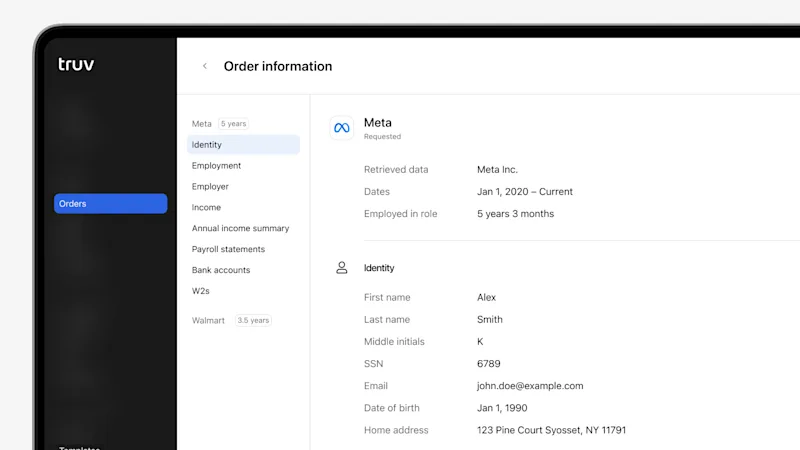

Truv Dashboard and Order Updates

- Refresh Orders: In addition to data refresh option on Income and Employment Verification orders, we’ve expanded order refresh to Asset Verification and Insurance Verification.

- Order Manager (OM) Home Page Access: Order Managers (OMs) can now be granted visibility into the Home page (Native reporting charts) to view metrics regarding orders created, completed, TAT, and error histograms. Administrators enable access.

- Partial Order Canceling: Now, you have the ability to cancel one or more selected employers in an order, even after an order was created and sent. This means you can make edits to a sent order and no longer have to cancel and re-create orders.

- Expanded Borrower Report Access: Borrower Reports for GSE submission can now be found within the latest task details. Navigate to the Download button on Truv Users > User page for this purpose.

Your Feedback Matters

An invaluable guiding principle at Truv has always been our customer feedback. Building products and introducing new integrations for you has always been at the core of what we do. Let us know how we can tailor Truv to best work for you.