At Truv, our client success is always top of mind. We engage closely with our clients to help them achieve peak performance, building better lending experiences for their loan officers, their teams, and their clients. Explore our roundup of product advancements made in June, then check out the upcoming events to attend with the Truv team in July.

Truv Platform Updates

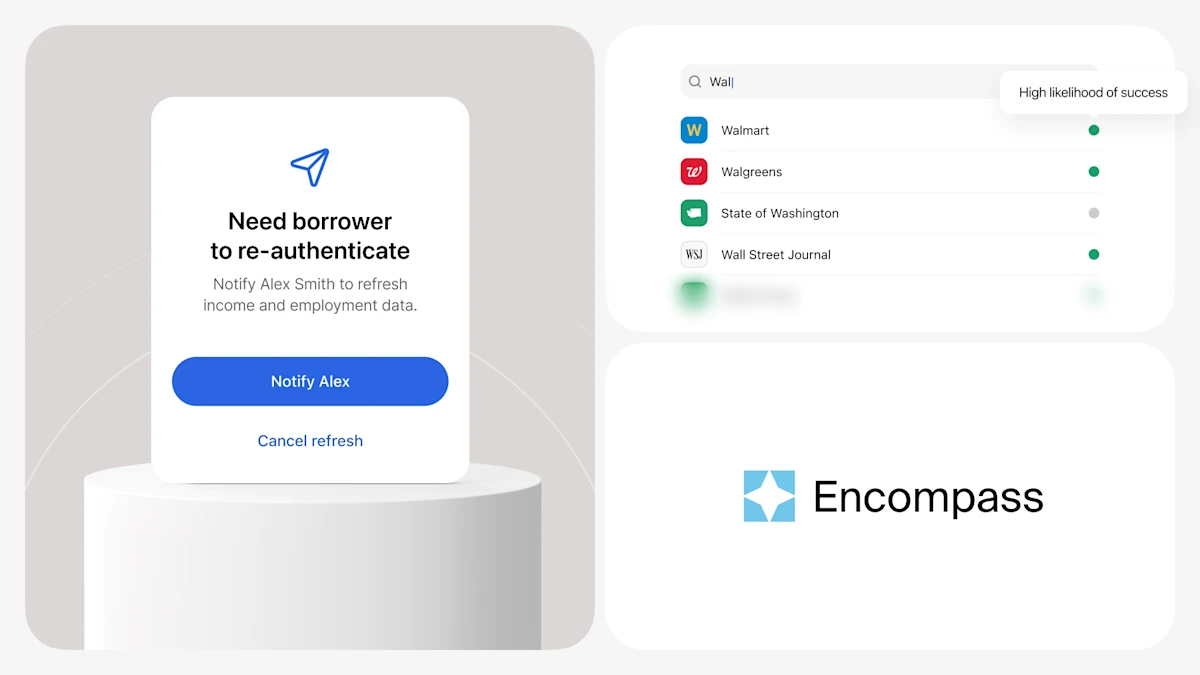

Encompass Improvements

If you’re looking for ways to elevate the verification of income and employment experience for your loan officers within the Encompass® interface, review the exciting enhancement we made last month.

- Unassigned Folder: As a fast follow to our eFolder Support feature that was release in May, now, lenders now have the option to send all returned documents from borrowers into the Unassigned File section within the eFolder. This offers more visibility into specific documents for underwriters, processors and loan officers if needed. From the Unassigned File section, the documents can be relocated into the eFolder.

Truv Dashboard & Order Updates

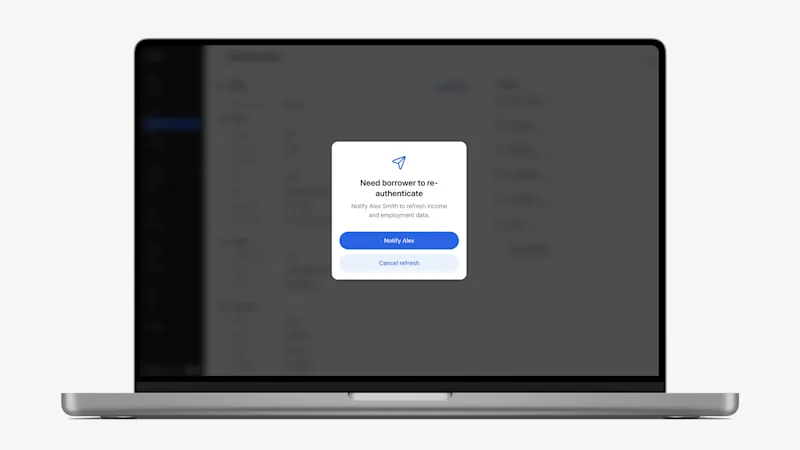

- Loan Officer Order Refresh Approval: For order refreshes, Truv automatically attempts a backend refresh using the credentials from the borrower’s first login. If the backend feature fails and borrower engagement is required to complete a re-verification, we’ve added a feature that gives Order Managers or Loan Officers two options:

- Notify the borrower – Truv uses an email address when provided, or the Order Manager manually copies the Truv link to send to a borrower when an email address is not provided.

- Cancel the refresh – This allows the Order Manager or Loan Officer to reach out to the borrower without re-introducing Truv.

If you’re ready to see Truv in action or learn about how Truv could work for you, reach out to the team today.

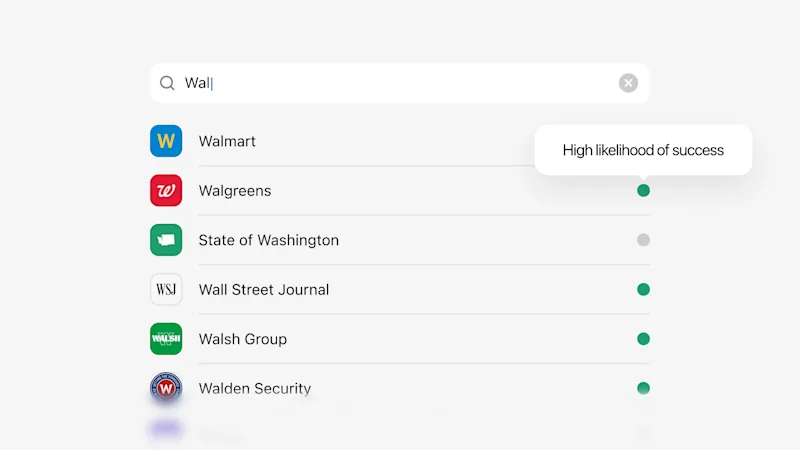

- Coverage Search Visibility: Within the Coverage Tab in Truv Dashboard, when a company name is searched, we’ve added indicators to give lenders heightened visibility into the likelihood of successful connections, based on recent Truv traffic. Additionally, the single sign-on provider (SSO) is listed when known.

- Green – Indicates a history of high success

- Yellow – Indicates a history of moderate success

- Grey – Indicates a history of low success

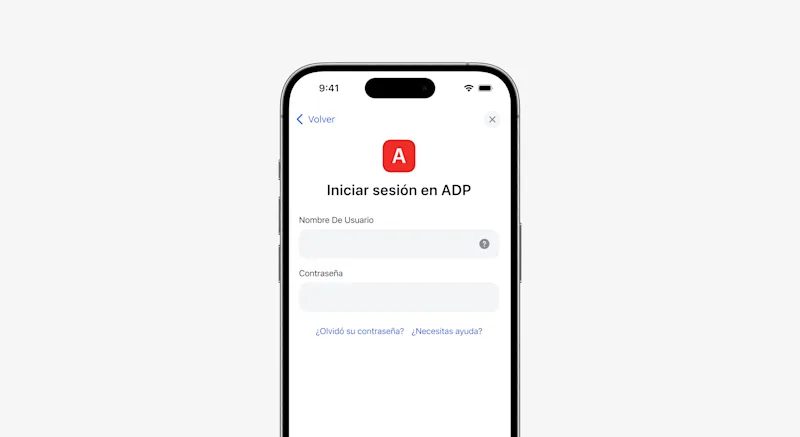

Truv Bridge Updates

- Language Selection: By default, the language of an order – English or Spanish – is based on the borrower’s browser and/or device settings. Now, Truv clients have the ability to select the language for any Truv product when creating a bridge token. This customization feature allows lenders to tailor Truv orders.

Upcoming Events

Webinars

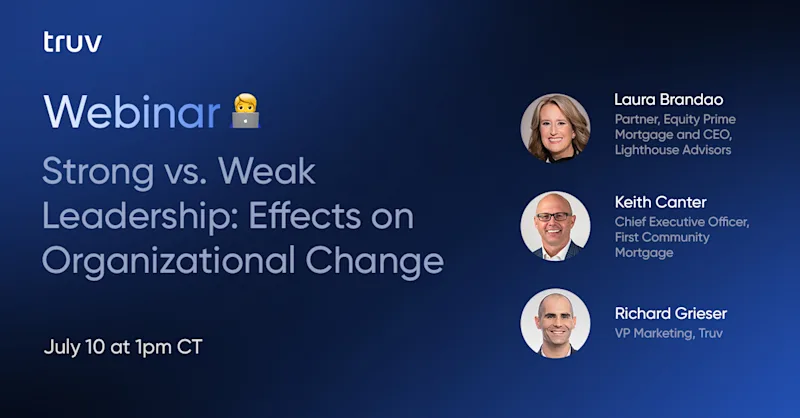

Strong vs. Weak Leadership: Effects on Organizational Change

On July 10, 2024 at 2 PM EST, join esteemed industry leaders, Laura Brandao of Equity Prime Mortgage, Keith Canter of First Community Mortgage, and Richard Grieser of Truv as they share their wealth of knowledge from over 40 years of combined leadership experience in the mortgage and business sectors. Gain valuable insights on leadership dynamics and discover strategies to elevate your business to new heights.

Mortgage Investors Group x Truv

On July 11, 2024 at 2 PM EST, tune in to hear Mortgage Investors Group share their experience with Truv, from savings to how they changed their tech stack, rolled out the solution to the organization, and gained adoption from their operations, sales and production teams.

Can’t attend the live webinars? Be on the lookout for recap posts to follow. In the meantime, stay tuned for more events, webinars, and podcasts, to come.

Customers Come First

Have any feedback for the Truv team? Let us know what Truv can do to best serve you. Your success is our success. We want to hear from you!