The Lender Saves 75% on Verifications

About

The Lender, a DBA of Hometown Equity Mortgage, is a leader in specialized lending, with a focus on business purpose loans and Debt Service Coverage Ratio (DSCR) products. With a nationwide presence across 49 states, The Lender’s wholesale mortgage volume represents 95% of its business and has established a growing presence in the non-qualified mortgage sector. The Lender’s closed loan volume totaled $1.9B in 2024 and is expected to increase production by 50% in 2025.

Problem

The decision to explore consumer-permissioned verification services was two-fold:

- Deliver a more efficient verification process to broker partners with less documentation retrieval and higher overall satisfaction, and

- Drive down operational costs, as The Lender was absorbing annual price increases with legacy verification providers.

Truv Solution

Verification of Income & Employment;

Encompass Integration

Mary Rodgers, EVP of Corporate Strategy, The Lender

“The cost of the Truv’s VOIE is the most important reason to use Truv. It is saving us thousands of dollars.”

The Story

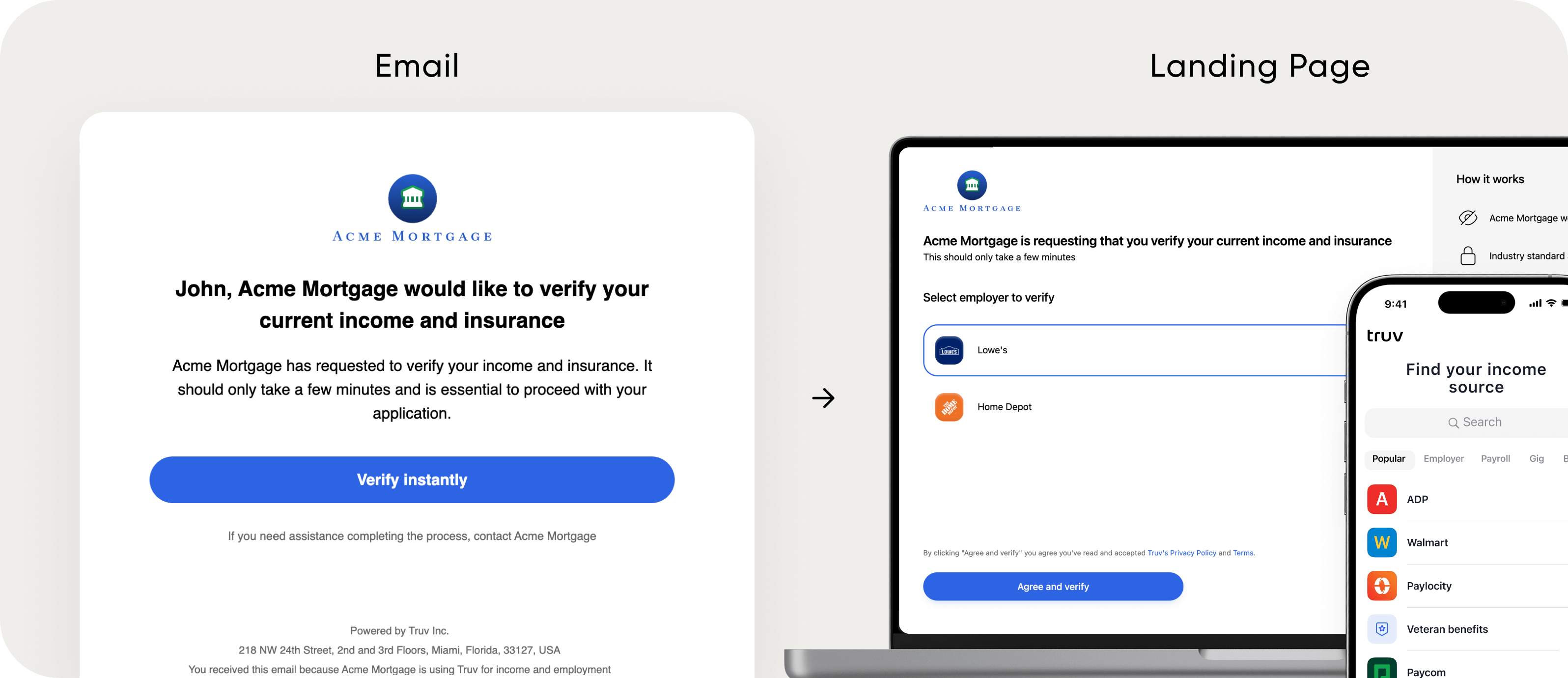

The Lender explored consumer-permissioned income and employment verifications with Truv to lower the cost of verifications and improve underwriting efficiencies with reliable, quality data. Following a seamless path to partnership, The Lender implemented Truv into their existing workflow.

Upon rolling out the new process, The Lender faced conversion challenges that resulted from borrower apprehension around using the digital verification tool. Operating exclusively through mortgage brokers meant The Lender had no direct contact with borrowers – a distinct challenge compared to retail lenders whose loan officers are on the frontlines guiding borrowers through the steps to complete consumer-permissioned verification. With a partnership-centric approach, Truv and The Lender strategized a tailored success plan.

Mary Rodgers, EVP of Corporate Strategy, The Lender

“Truv partnered with us from the start, tweaking and adjusting the process to increase our pull through and conversion percentages.”

Through methodical testing and refinement of templates, the lender discovered a key insight:

incorporating broker information, including broker name, logo, and branding, into borrower communications dramatically improved trust. By helping borrowers recognize the connection to their loan application through familiar mortgage broker rather than an unfamiliar lender, engagement improved and order completion rates increased, driving conversion up by 10%.

Broker awareness played an equally important role to driving conversion.

As borrower-facing refinements were implemented, The Lender simultaneously invested in regular trainings for their Account Executives, empowering them to effectively communicate the benefits of Truv’s verification process to broker partners. As the AEs worked with brokers, The Lender saw an immediate uptick in buy-in from brokers. Quickly, brokers became Truv advocates, realizing that when they served as advisors to their borrowers and explained the benefits of consumer-permissioned verifications, the borrowers spent less time on document retrieval and experienced faster closings.

Mary Rodgers, EVP of Corporate Strategy, The Lender

“We’re rolling out template letters to go out to brokers when they receive loan conditions. Attention is high to get the loan closed, so we’re adding a Truv reminder touchpoint and monitoring for an uptick in conversion.”

To optimize conversion rates, The Lender has plans to

enhance their workflow further by adding Account Managers into the consumer-permissioned education process, as they serve as the primary liaison with brokers. When a W2 borrower loan receives approval, Account Managers will automatically notify the broker about the Truv verification process by sending a template letter with a process overview reminder. The touchpoint is strategically timed to coincide with when brokers are receiving updates on conditions for the loan approval. With maximized engagement, the letter is designed to facilitate an incentive for the broker to encourage the borrower to complete the digital verification.

Mary Rodgers, EVP of Corporate Strategy, The Lender

“We use Truv on all conventional FHA, VA, and income-qualifying non-QM loans, representing approximately 25% of our business.”

As The Lender advances toward their 2025 production goals,

their unwavering commitment to broker-centric service continues to guide their strategic decisions. Their successful integration of consumer-permissioned verifications into a wholesale lending model demonstrates their innovative approach to automation. The balance of technological advancement and personalized service has not only enhanced operational efficiencies and scaled back costs but also reinforced The Lender's position as a forward-thinking leader in wholesale lending, setting the stage for continued growth and success.