July marked the last month of Q2 at Truv, and our team closed out the quarter with significant product enhancements to elevate the performance and experiences of loan officers, their teams, and their customers. Discover the latest product innovations below and get a first look at the exciting events we have lined up to kick off the first month of Q3!

Truv Platform Updates

Encompass Improvements

If you’re looking for ways to elevate the verification of income and employment experience for within Encompass®, the Truv team regularly releases enhancements to elevate the verification process for loan officers.

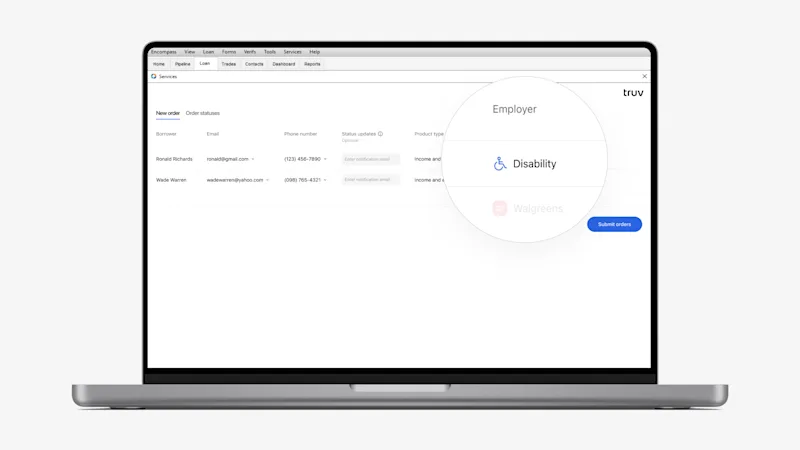

- Auto-Added Income Sources: Moving forward, Truv orders will automatically include all income sources, such as benefits and retirement, as listed in Section 1E of the employment or income form on the loan application. Previously, additional income sources had to be manually added by the Order Manager, Processor, or Loan Officer. Now, they will be seamlessly integrated into the order creation process. If any of these additional income sources are not required for verification, they can easily be removed during the order review.

Truv Dashboard & Order Updates

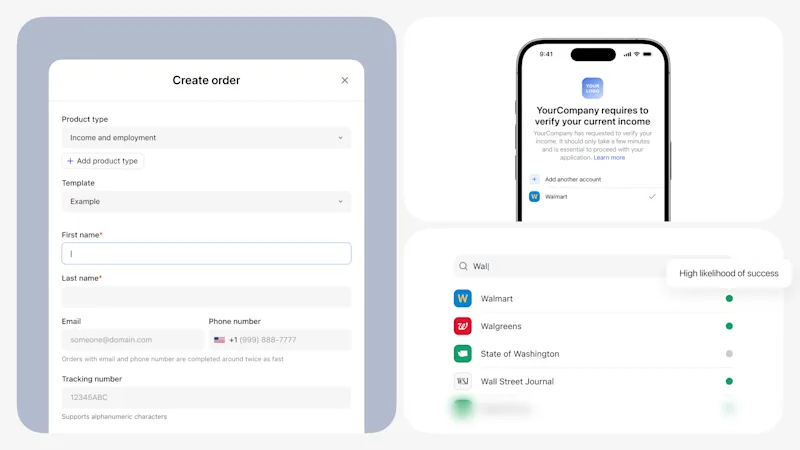

- Enhanced Order Form: On Truv Dashboard, we launched a new order form, re-designed with Truv user feedback in mind. The new form brings a host of improvements aimed at streamlining your workflow and making order creation a more intuitive and efficient process.

- Skip, Add, or Complete Connections: Before this enhancement, our clients’ customers were required to complete every requested connection in an order, with no option to modify the connections provided. Now, end users have greater flexibility—they can add or skip connections and complete the order at their convenience. This improved functionality aligns with our Truv mission: to empower consumers to take control of their data.

- Additional Coverage Visibility: Prior to sending an order, loan officers and all Truv users have increased insight into the likelihood of their customer achieving a successful connection. Our color-coded indicators have been added to our Coverage Search tool and populate upon the search result of an employer. This empowers loan officers to know when to send an order (green indicator), when to notify Truv (yellow indicator), and when to use an alternative method to collect information from a customer, such as Truv’s Document Upload (gray indicator).

Upcoming Events

Webinars

See LenderLogix and Truv in Action!

On August 6th, we hosted a webinar with LenderLogix to demo the new Truv and LenderLogix integration! Lenders can now access Truv’s consumer-permissioned data platform through LenderLogix’s point-of-sale (POS) LiteSpeed to obtain direct-to-source income and employment verification for mortgage applicants. Watch here!

See BeSmartee and Truv in Action!

On August 22nd, we are hosting a webinar with BeSmartee to demo our integration! Truv has seamlessly integrated with BeSmartee’s mortgage POS platform, Bright POS, to automate manual verification processes and transform the mortgage experience for lenders and borrowers. Register here.

Events

CMBA Western Secondary

From August 19th-21st, Truv is attending California MBA Western Secondary Market Conference. Ready to explore solutions for mortgage verification and chat industry trends? Let’s meet!

TMC a Mile Above

From September 8-10th, Truv is attending TMC a Mile Above in Denver, Colorado. When a borrower verifies with Truv, lenders realized 60-80% savings, and you get up to five re-verifications free of charge. Join us in Denver to learn more!

Customers Come First

As always, your feedback is our top priority, and we are committed to continuously improving our products to help you achieve your business goals. Please continue to share your feedback with the Truv team!