Overview

AmeriSave is a nation-leading consumer-direct mortgage lender that has served more than 730,000 borrowers over two decades across 49 states. With a customer experience-centric business philosophy, proprietary technology infrastructure, and brick-and-mortar-less operations, the company reaches 95% of mortgage loan borrowers through phone-based sales while processing loans through homegrown systems and an applicant portal, facilitating a sophisticated digital process that has led to $130 billion in funded loans.

Truv delivers on every front. Costsavings, product innovation, reliabletechnology, and most importantly,a partnership approach that keepsour success at the center of everythingthey do. That’s the kind of partnerevery lender needs.Truv delivers on every front. Cost savings, product innovation, reliable technology, and most importantly, a partnership approach that keeps our success at the center of everything they do. That’s the kind of partner every lender needs.

Magesh Sarma

Chief Information and Strategy Officer, AmeriSave

Challenge

AmeriSave’s efficiency-focused, borrower-first lending model faced gaps in their verification process, including rising costs, slower underwriting turntimes, manual workflows, and borrower friction. When AmeriSave set out to improve their verification process in 2020, consumer-permissioned income and employment verifications were new to the market.

As legacy verification providers continued to increase prices year-over-year while returning complete data sets on only 50% of loan files, AmeriSave sought a solution that could:

- Improve profitability and operational efficiency

- Reduce cumbersome document processes from days to seconds

- Replace opaque human interpretation with automated, high-quality data

- Integrate seamlessly with proprietary systems (AUSSIE)

Solution

- Verification of Income & Employment

- Custom integration

We needed more than justa cost-effective solution. We neededa partner we could count on—onethat delivers not just on features andfunctionality, but on the promise thattheir platform will work reliably, dayin and day out. Now, it is 5 years later,and Truv has proven to do exactlythat.We needed more than just a cost-effective solution. We needed a partner we could count on—one that delivers not just on features and functionality, but on the promise that their platform will work reliably, day in and day out. Now, it is 5 years later, and Truv has proven to do exactly that.

Magesh Sarma

Chief Information and Strategy Officer, AmeriSave

The Partnership Story

In early 2020, when Truv was still operating under the founding name Citadel, AmeriSave partnered with Truv to explore the efficacy and impact of consumer-permissioned income and employment verification. As an early advocate of this new verification model, AmeriSave took a leap of faith and introduced an industry newcomer into their workflow: Truv.

AmeriSave’s proprietary system architecture required extensive custom API integration work. Rather than viewing this as an implementation obstacle, both organizations embraced the complexity to create a truly seamless customer experience, completing the custom build in under three weeks. Truv’s product & engineering team worked directly with AmeriSave’s developers to embed the income verification solution within AmeriSave’s existing applicant portal, eliminating multi-platform friction.

Before Truv, the borrower was alreadyconnecting to their payroll systemto download documents and uploadto us. With Truv, the borrower simplyconnects to the payroll provider withno additional steps. We instantlyreceive a complete data set with theability to re-verify pre-closing withouthaving to contact the borrower again.Before Truv, the borrower was already connecting to their payroll system to download documents and upload to us. With Truv, the borrower simply connects to the payroll provider with no additional steps. We instantly receive a complete data set with the ability to re-verify pre-closing without having to contact the borrower again.

Magesh Sarma

Chief Information and Strategy Officer, AmeriSave

The strategic value became immediately apparent:

- Customers could connect directly to payroll systems without the download-upload cycle.

- AmeriSave received original-quality documents with structured data.

- The manual transcription bottleneck was solved for.

From the earliest stages of the initial rollout, Truv’s market-leading coverage, which has since grown to include 96% of the US workforce, proved reliable as borrowers began using this 30-second, digital process. Immediately, AmeriSave saw the value of building a customized verifiaction waterfall with Truv to enhance the current workflow, while improving the loan origination experience for both sales teams and borrowers.

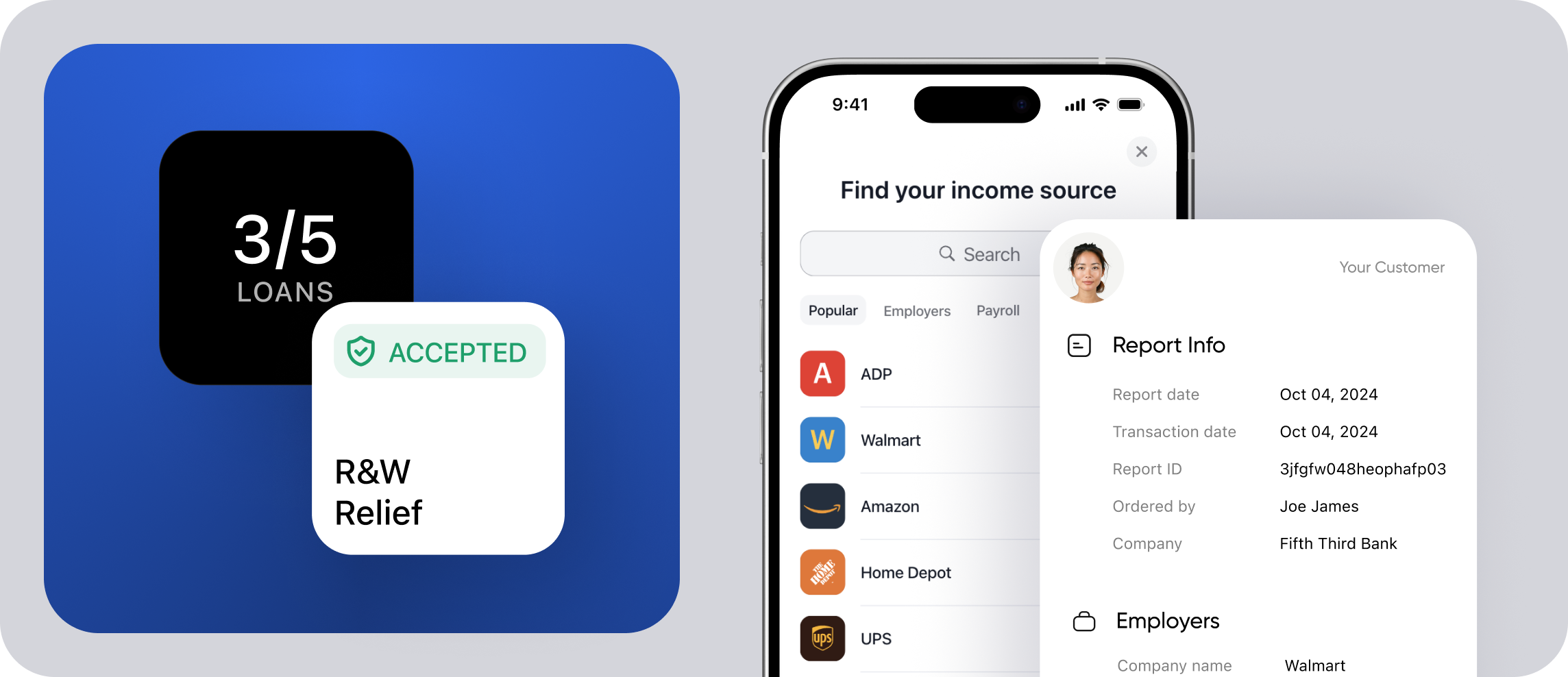

Three out of five of our loans that useTruv to verify income and employmentreceive rep and warrant relief, whichis higher than we’ve seen with othervendors.Three out of five of our loans that use Truv to verify income and employment receive rep and warrant relief, which is higher than we’ve seen with other vendors.

Magesh Sarma

Chief Information and Strategy Officer, AmeriSave

What distinguished this partnership beyond product performance was Truv’s commitment to co-building solutions tailored to AmeriSave’s specific needs and their investment in mutual innovation. To achieve broader adoption with AmeriSave and the lending industry at large, Truv dedicated substantial resources to solidify approvals from Fannie Mae and Freddie Mac.

Truv actively sought out lender sponsor information from AmeriSave, leveraged GSE pilot data insights, and maintained continuous dialogue throughout the certification process. Truv was becoming more than just another vendor to AmeriSave, but a true partner committed to solving client needs.

In a pursuit to become the market’s leading provider of buyback protection and quality data, Truv shaped early feedback from AmeriSave into refinements that have since surpassed the lender’s expectations: Today, three out of every five loans using Truv’s verification reports receive representation and warranty relief, providing lenders with unmatched buyback protection—a testament to Truv’s dedication to client success.

Truv’s platform delivers exceptionalreliability and dependability that setsit apart from other technologysolutions. When lenders can trust thatthe platform is always going to work,it eliminates internal friction aroundusing the product and ensures peaceof mind that we are delivering aseamless experience to borrowers.Truv’s platform delivers exceptional reliability and dependability that sets it apart from other technology solutions. When lenders can trust that the platform is always going to work, it eliminates internal friction around using the product and ensures peace of mind that we are delivering a seamless experience to borrowers.

Magesh Sarma

Chief Information and Strategy Officer, AmeriSave

Over the past five years of the partnership, the sustained growth, innovation and compounding successes were driven by Truv’s:

Speed of Innovation

Feature requests often moved from concept to production within 30-60 days, demonstrating Truv's commitment to continuous improvement and partnership value.

Integrated Technical Support

Direct expert-to-expert connections eliminated ticket-based delays and enabled immediate problem resolution.

Platform Reliability

Consistent system uptime and performance proved essential for driving adoption, maintaining internal support, sharing wins, and ultimately, growing customer confidence in a newer, faster verification process. Unlike other service vendors AmeriSave had worked with, Truv’s platform dependability eliminated internal friction around product adoption.

Exceptional Borrower Experience

Two out of three borrowers successfully connect their payroll provider when prompted to verify income & employment via Truv, demonstrating strong borrower engagement and delivering complete data sets and documents required for underwriting in real time.

Truv is a true innovator, a partner thatcan be trusted to move very quickly,and a vendor who listens and seeksimprovement. This is what drives oursuccess with Truv at AmeriSave, andwhat will drive the industry forward.Truv is a true innovator, a partner that can be trusted to move very quickly, and a vendor who listens and seeks improvement. This is what drives our success with Truv at AmeriSave, and what will drive the industry forward.

Magesh Sarma

Chief Information and Strategy Officer, AmeriSave

What began as a solution for specific operational challenges has transformed into a strategic partnership that has unlocked new business opportunities through shared innovation and mutual trust. As AmeriSave continues to evolve, this collaboration will scale alongside their growth, driven by a foundation of proven results and aligned objectives. The alignment has created a relationship built not just on technology, but on a shared commitment to advancing the lending experience industry-wide.

About Truv

Truv empowers 150+ lenders to instantly verify income, employment, and asset data directly from the source. With best-in-class coverage, configurable workflows, and a focus on consumer-permissioned data, Truv helps financial institutions streamline underwriting while dramatically reducing costs. Truv's full suite of solutions provides GSE-eligible reports for submission to Freddie Mac and Fannie Mae, protecting lenders from buyback risks and delivering market-leading data quality. Learn more at truv.com