August was a busy month at Truv, filled with exciting product updates and new feature releases to build on our full suite of verification products. It’s not secret that when we build our products, we build with conversion optimization top of mind. Let’s dive into the latest developments below!

New Product Announcement

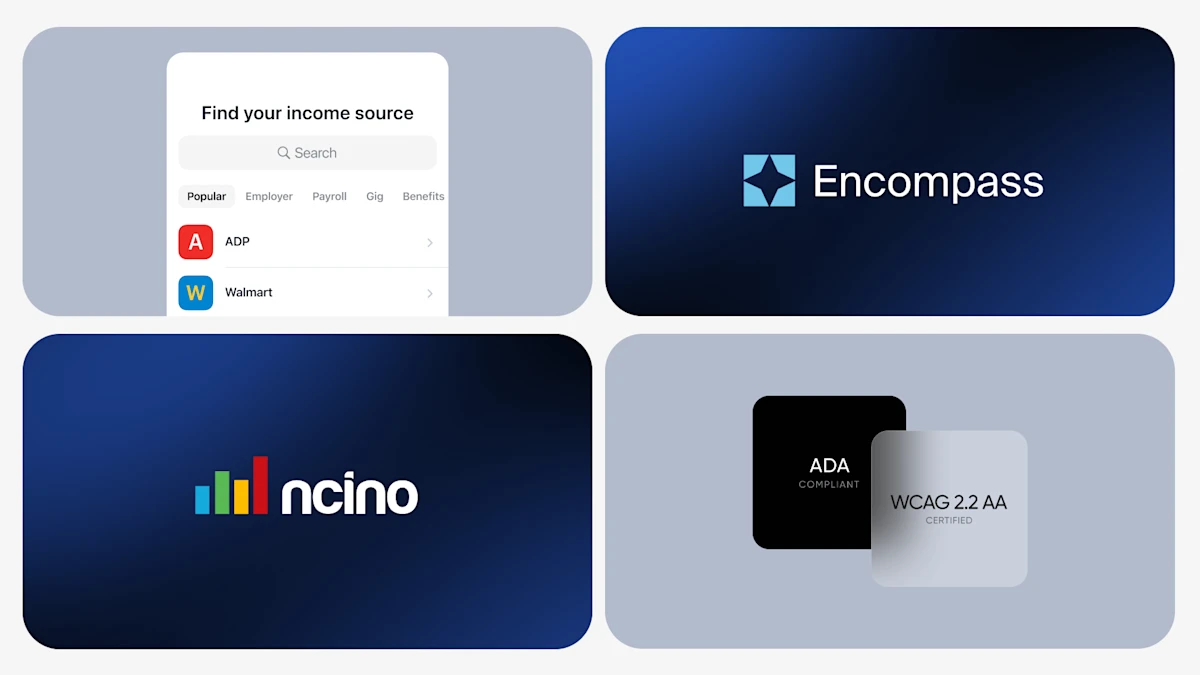

nCino Integration Offers Embedded Verifications

We’re thrilled to announce Truv’s enhanced integration with nCino! Lenders can now access embedded income, employment, and asset verifications directly within nCino’s POS platform, creating a seamless, faster, and easier mortgage application process for both loan officers and borrowers.

What’s new?

- Real-time income, employment, and asset verifications embedded in the 1003 loan application – no external emails & SMS links.

- Instant access to leading payroll coverage for VOIE: 96% of the US workforce.

- Instant access to expansive financial account connections for VOA: 13K+ financial institutions.

- Fully customizable verifications with expanded features and functionality, all in one solution.

- No implementation delays: configure settings for VOIE &/or VOA in just a few clicks.

Mortgage lenders on nCino, get ready for faster decisions and smoother processes beginning at the application!

Learn more about this exciting update here.

ADA Compliance & WCAG 2.2 AA Certification

We are pleased to announce that Truv is now fully ADA compliant, WCAG 2.2 AA certified, and meets Section 508 standards, ensuring the Truv platform is accessible to all users, including those with disabilities. This compliance reflects our commitment to ease of navigation and aligns with the Americans with Disabilities Act (ADA) and Section 508, which guarantee equal access to services and technology for everyone. For Truv clients, this is particularly important, as it allows Truv to better serve a broader range of your customers, including those with visual, auditory, or mobility impairments. By meeting ADA, WCAG 2.2 AA, and Section 508 standards, we are proud to enhance the user experience for all Americans.

Truv Platform Updates

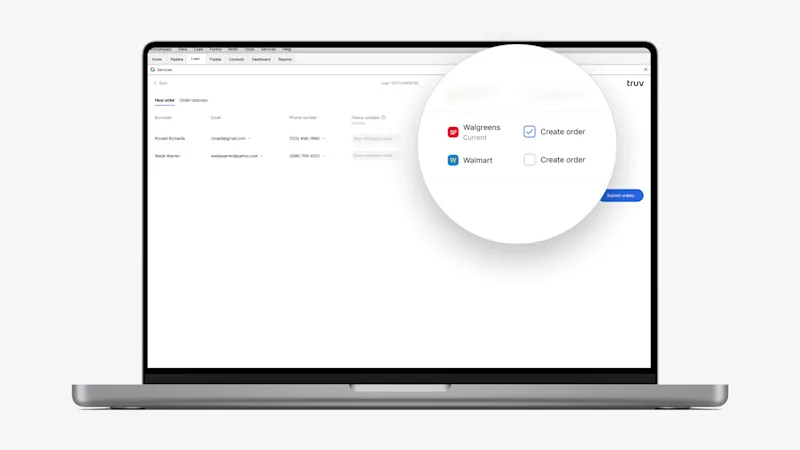

Encompass Improvements

The Truv team has steadily released new enhancements to our Encompass integration over the last few quarters to deliver our clients the best-in-class experience for their lending teams and borrowers. Check out the latest improvements in Encompass:

- Expanded Status Update Customization:

- When a verification of income & employment order is created in Encompass, the recipients of status update emails can be added or deleted. Now, we’ve expanded the customizable functionality of the cc feature to include editable recipients on refresh orders. This helps lenders keep underwriters, closers, & other critical team members up to date every step of the way, particularly when a 10 day pre-closing verification of employment has been ordered.

- To ensure the highest level of visibility into loan file status, we’ve enhanced the email notifications status updates to deploy seamlessly for both manual and Automated Service Ordering (ASO) workflows. Status updates deliver promptly during the loan process, paving the path for faster loan processing and closings.

- Expanded Income Sources: Last month, Encompass users started seeing additional income sources, including Disability, Social Security, and VA Benefits NonEducational income sources within Encompass. When one of the eligible benefit types is entered into ‘Section 1e. Income from Other Sources’ in Encompass, the income source automatically appears as a verification option within the order. When the borrower successfully completes the order, Truv returns the income & employment report as well as the most recent Benefits Letter.

- Auto-Select Current Employer for Orders: To increase efficiency at the order creation stage in Encompass, we’ve added a setting that automatically pre-selects a borrower’s ‘Current’ employer(s) when an order is created in Encompass. Any employers entered into the Previous Employment section are not pre-selected. This feature is also available to lenders who leverage Automated Service Ordering (ASO) workflows. If the lender creates Truv orders automatically with ASO, the order will be placed with only the pre-selected ‘Current’ employers. Reach out to the Truv team to enable this setting.

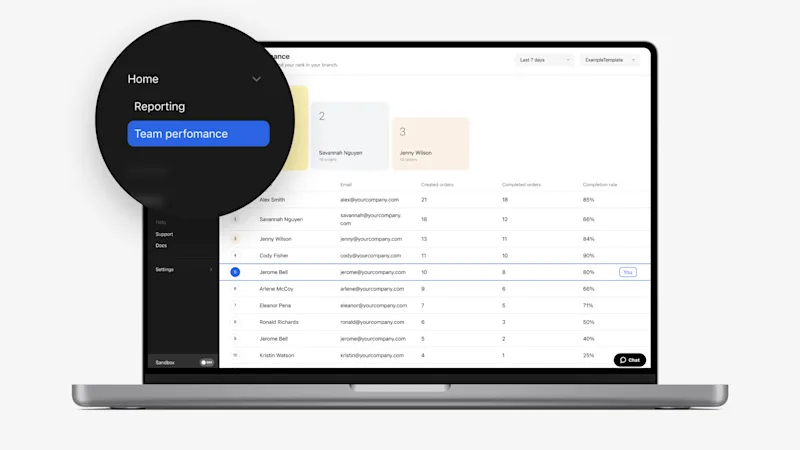

Truv Dashboard & Order Updates

For Truv clients who leverage orders directly within Truv Dashboard, we’re excited to introduce new features and functionality that offer more customizations and more reporting insight.

- Order Manager Performance Within the Truv Dashboard, we’ve expanded our client view into Order Manager performance to include helpful insight, from number of orders to conversion. Team performance can be viewed within the Dashboard, with the option to export and share results. We’ve also provided the option to view performance by template, offering insight for clients who leverage templates to distinguish branch locations and/or multiple product types.

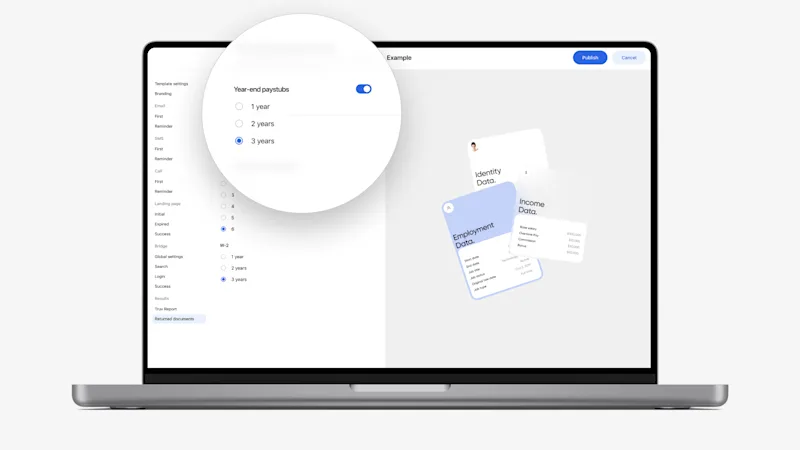

- Configurable # of Paystubs: In Truv Templates, Verification of Income and Employment (VOIE) customization functionality has expanded to allow you to select the number of Year-end paystubs required for retrieval. Prior to this customization option, Truv retrieved the three most recent year-end paystubs, but now lenders have the option to tailor the number. Owners or Admins can make changes to VOIE Templates by navigating to Truv Dashboard > Templates > Returned documents.

Upcoming Events

From regional and annual events to industry-specific and product-specific webinars, Truv is always excited to connect with our industry peers. Here’s where we’ll be in the coming weeks:

Events

ACUMA Annual Conference

From September 29 – October 2,Truv is participating in ACUMA, the largest gathering of credit union mortgage lenders in the United States. Truv is a Freddie Mac Loan Product Advisor® asset and income modeler (AIM) provider and Fannie Mae Desktop Underwriter® (DU®) validation service provider—the only consumer-permissioned VOIE platform with both accreditations, solidifying our commitment to delivering top-notch verification services tailored for credit unions. Meet with us to learn more!

HousingWire IMB Summit

On October 1, Truv is joining mortgage banking executives, leaders, and rising stars to discuss the ins and outs of navigating a “higher for longer” mortgage rate environment, with an emphasis on initiatives that drive the bottom line—M&A activity, margin compression, channel balance, new products, and tech stack optimization. Are you attending? Let’s meet!

MBA Annual

Truv is proud to sponsor of this year’s MBA Annual! From October 27-30, Truv will be at the Colorado Convention Center in Denver at our booth in The Hub Expo. To learn about our instant, automated VOIE and VOA with unlimited, free re-verifications and industry-leading coverage, meet with the Truv team.

Webinars

Mastering Mortgage Tech Adoption: From Internal Alignment to Execution

On September 12 at 1pm CT, hosted join a webinar hosted by HousingWire with Juliet Leibon, Senior Director, Operations & Strategic Partnership at Better Mortgage and Richard Grieser, VP of Marketing at Truv as they share lessons and insights from their experience in the mortgage industry. Learn how to build a robust change management framework that aligns people, processes, and technology, ensuring higher adoption rates and optimal use of your technology investments.

Customers Come First

From day one, Truv has centered its success on our client success! Our collaborative partnerships are what drive many of our product enhancements and new features. Please continue to share your feedback on all things Truv with the team!